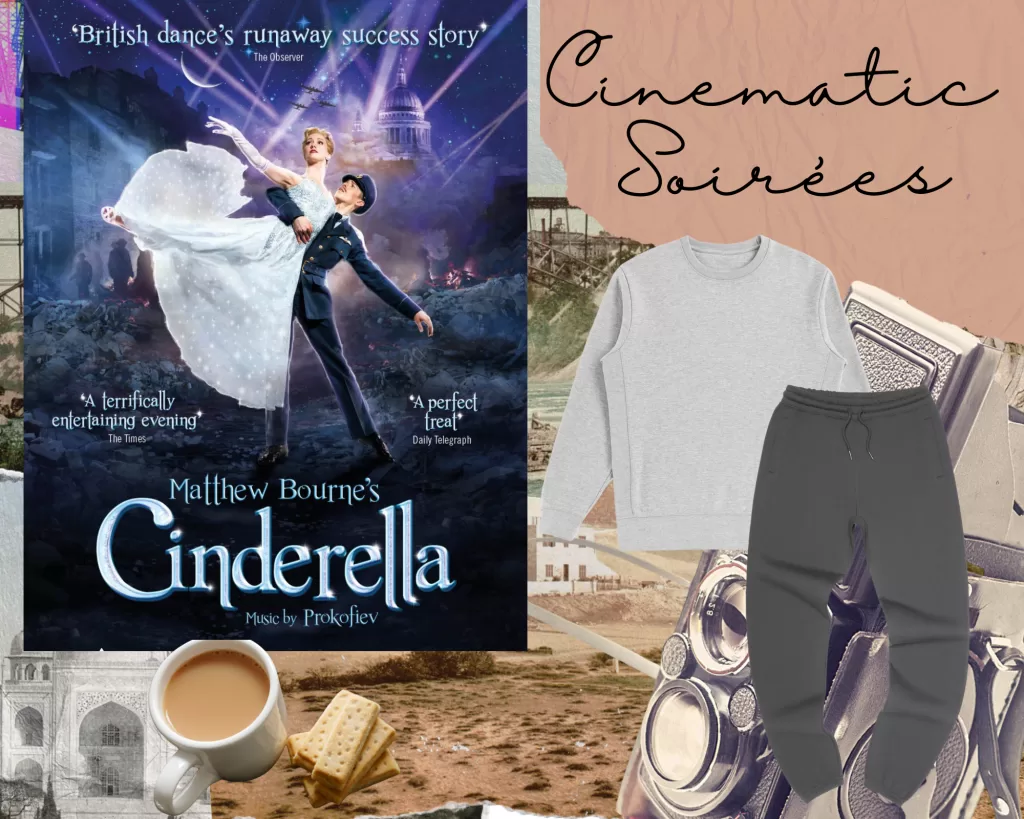

The Show Spotlight

- Matthew Bourne’s Cinderella (2017)– The Blitz rains down over London, casting shadows across the city, yet amidst the chaos, a love story flickers like candlelight. In this breathtaking adaptation, Matthew Bourne weaves Prokofiev’s sweeping score into a darkly enchanting wartime romance. Cinderella is no longer a girl waiting to be rescued but a dreamer lost in a world at war, swept into an ephemeral love affair that feels as fragile as the world around them. Haunting, grand, and deeply cinematic, this ballet is a masterpiece of reinvention.

The Cozy Chic Look

- A moonlit silver sweatshirt, soft as a whispered promise, paired with charcoal-gray sweatpants, reminiscent of London’s misty streets, and barefoot or delicate lace-trim socks, because some magic is best felt unencumbered.

The Snack & Sip Pairing

- A warm cup of Earl Grey tea, fragrant with bergamot, evoking the quiet sophistication of an English evening. Paired with buttery shortbread biscuits, simple yet elegant just like the film’s timeless love story.

The Show Breakdown

- Why It’s a Pick: Matthew Bourne’s Cinderella is a feast for the senses, transforming a well loved tale into something hauntingly beautiful. It’s a ballet that feels more like a dream a love letter to old Hollywood glamour, resilience, and the enduring power of hope.

- Standout Moments: The mesmerizing ballroom sequence bathed in silvery light, the raw tenderness of Cinderella and her pilot’s fleeting moments together, and the film’s final bittersweet embrace that lingers like a ghost of the past.

The Mood & Experience

- The tea steams in your hands as the first notes of Prokofiev’s score fill the room, rich and melancholic. London’s wartime glow flickers on the screen, wrapping you in a world of lost letters, midnight encounters, and whispered dreams. The film doesn’t just unfold it washes over you, its movement and music seeping into your bones. By the final scene, you aren’t merely watching you are feeling.

Check out our last Cinematic Soirées: Nine here. What ballet or fairytale adaptation has transported you to another world? And more importantly how would you make an afternoon of it?

If you’ve been craving a way to move without judgment, Movement for Movement’s Sake offers 10 gentle days to reconnect with your body on your terms. HERE!

[…] out our last Cinematic Soirées: Matthew Bourne’s Cinderella here. What piece of classical music has moved you beyond words? And more importantly—how would you […]